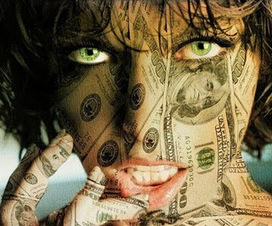

U.S. Economist Richard Wolff talks about the Crisis in the U.S. and Europe

The crisis in the U.S. and Europe is not a pure financial crisis, says Wolff. Especially in the U.S. wages have stagnated or even declined since the 70ies with increasing working hours. To keep the consumption going private households and the state had to build up huge debts while assets have concentrated more and more in a small group of capital owners. Instead of paying higher wages workers got loans from the capital owners. At the breakout of the crisis in 2007/2008 this construction collapsed. The system has no way of solving the problem. "The irony is that all the attention these days is on little Greece or Italy. But the much bigger problem is the U.S.", says Wolff. The States already have as debt more than their GDP. These growing debts are like a "big elephant" running towards Europe. But nobody wants to deal with that. The unprecedented Occupy movements have been very successful so far. They unite different movements, challenge the capitalist system and get sympathy from the majority of the population.

Your new post is loading...

Your new post is loading...

I small suggestion. When you have a video, try to integrate it here directly, and in the title put the word video at the end within square brackets [Video] - that's kind of a convention to specify the type of format of your content. (For the video integration ping me and I'll show you live). :-)